Many Structured Products are built around an Index that gives investors direct exposure to a country, region or sector. Products linked to a single mainstream index, such as the Eurostoxx 50, Nasdaq 100 or Eurostoxx Banks, are popular worldwide and usually at the allocation’s core. Other indices like Emerging markets or ESG can also help diversify a balanced portfolio. However, it can be attractive to create a product linked to a custom basket of stocks instead.

In this article, we will analyse the pros and cons of using an index versus a basket of stocks. Creating single-name products is also possible, but the ‘worst-of’ mechanism on two or three underlyings usually generates extra yield for reasonable risk.

Advantages of an index

Mainstream benchmark indexes have become familiar over the years. Most investors know them well, and they are, therefore, easy to use from a regulatory / compliance standpoint. Futures and options markets are very active on mainstream indices. Banks have developed effective strategies to hedge thanks to liquidity on Index Derivatives, which reduces costs and facilitates the issuance of longer-term products. Exchange Traded Funds (ETFs) have recently made a broader range of indices available at an attractive cost.

Choosing the right basket

A basket of stocks is usually more volatile than an index and tends to pay a better yield. Depending on your target coupon, the three main parameters to select the right underlyings within a basket are:

- Volatility

- Dividends

- De-correlation between the components of the basket

The more volatile, the more dividends, and the more De-correlation, the higher the coupon the product pays. For improved risk management, the stock selection must be validated by fundamental and technical analysis: growth, valuation, newsflow and trading on support.

In the case of a worst-of-basket, we would typically expect no more than three stocks, whereas an average basket could comprise up to ten names. Maturity on basket-linked products is shorter than on indexes because the choice of stocks needs to remain relevant and compelling over time. Stock substitution is a risk following corporate action event: share split or takeover for example.

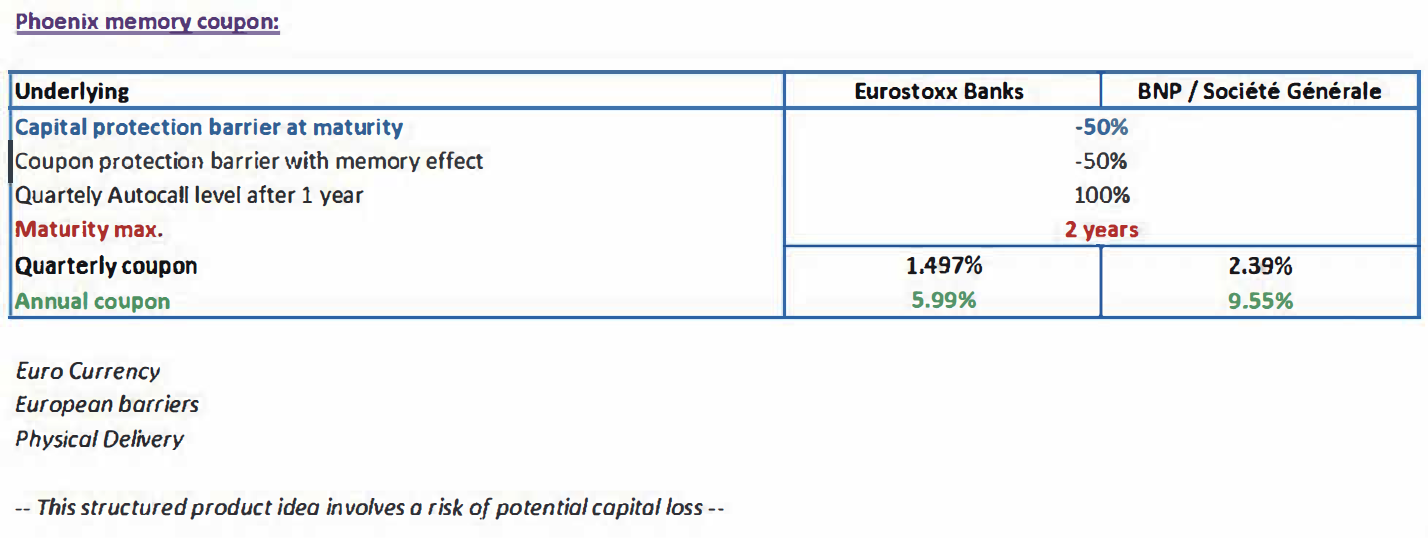

In the example below, and for the same structure, you will see the difference between the coupon on an index (Eurostoxx Financials) and a worst-of basket on two French banks, BNP and Société Générale:

Interested in learning more?

The Hilbert Investment Solutions team specialises in structured investments for retail clients and institutions. This experience enables us to develop tailor-made products offering attractive yield and strong capital protection.

For more information regarding our solutions or other products and services, please visit www.hilbert-is.com. Alternatively, call +44 203808 7138 or email contact@hilbert-is.com.

Arnaud Schmitz – Structured Products Sales