Historically, investment banks have purchased indices and stocks to hedge their long exposure when issuing structured products. However, in the past few years, decrement indices have also been rising in popularity within this sector.

Alongside this, firms have recently been cutting or cancelling intended dividend payments to buffer against economic uncertainty during and after the COVID-19 pandemic. As a result, you may see an underlying expected to pay a 5% p.a. dividend yield with an “implied” level of dividends trade at 4%.

Banks are reluctant to give the total dividend value when they price a product, because they risk significant losses when exposed to dividends falling over the product’s life (as there would be no reduction in the fixed coupons they are committed to paying the investor).

So, the decrement index wascreated to eliminate this risk, meaning issuers could provide more favourable terms at the structural level, such as higher participation rates and improved capital protection.

What are decrement indices?

A decrement is an overlay applied to equity indices. A decrement index will define a fixed rate (synthetic dividend) either as a yield or points amount. It is constructed by deducting a predefined dividend from a total return index on a daily basis.

Decrement indices use two main methods to deduct the predefined dividends: fixed percentage (which deducts a fixed percentage of the returns) or fixed points (subtracts fixed index points from the index level) daily.

The fixed percentage method provides a dividend yield that tends to have long-term stability. On the other hand, a fixed points deduction captures the consistency in dividend amounts in the short term, allowing companies to maintain more stable dividend policies compared to their earnings.

Investors can capitalise on the higher coupons that decrement indices provide over normal indices, at a time when the real indices exhibit falling dividend levels. When the market is stable or steadily increasing, decrement indices tend to be more beneficial to investors compared with the price return index. However, it’s worth noting that in adverse market conditions, decrement indices may represent a large reduction in returns.

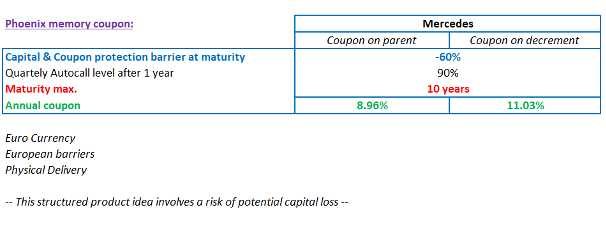

As an example, let’s look at the Solactive index MERCEDES-BENZ AR 5 (ISIN: DE000SL0FV02). This is a synthetic index that replicates the performance of the Mercedes share (ticker: MBG GY Equity) with gross dividends reinvested and an annualized decrement of 5 euros, corresponding to future dividend estimates (“Forecast”) as of December 2021. The decrement is deducted daily (pro rata temporis) from the Gross Total Return performance of the security.

Performance versus the parent security: The decrement index could underperform versus the parent security if the future dividend realised is lower than the 5 euros decrement. Conversely, the decrement index could outperform the parent stock if the future dividend realised is greater than the 5 euros decrement.

Price efficiency: Since it eliminates the dividend risk for the issuer (indeed the decrement of 5 euros is invariant over time), the parameters of the structured product are generally improved compared to the same structured product linked to the parent security.

Pricing improvement: When the market conditions allow it, the value generated by the transition to the decrement index can be reinjected in several different ways in the optics of the product: higher target yield (+2% on average), lower capital barrier, more frequent early call observations.

Key takeaway

The decrement index strategy aims to solve specific challenges presented by structured products; a low-interest rate environment and the need to hedge dividend risk. Despite the simple construction, there are nuances that investors may want to better understand, such as potential underperformance when the deduction is too high and varying deduction methods.

Interested in learning more?

The Hilbert Investment Solutions team specializes in structured investments for retail clients and institutions, this experience enables us to develop tailor-made products offering attractive yield along with strong capital protection.

For more information regarding our solutions, or to enquire about other products and services, please visit www.hilbert-is.com. Alternatively, call +44 203808 7138 or email contact@hilbert-is.com.

Arnaud Schmitz – Structured Products Sales