Pandemic proved no barrier to growth

One year on from the outbreak of the coronavirus pandemic, we are able to reflect on what has ultimately been the best performing period for the sector over the course of the past 12 months.

Consistent with the accelerated vaccination scheme and subsequent steady easing of lockdown restrictions, this article is written with a sense of optimism looking ahead and should reaffirm the credibility of structured products as an investment option – even during a pandemic.

At the beginning of January 2021, the FTSE 100 Index was at 6,571.88 – more than 1,000 points below its level a year earlier.

Over the first quarter of 2021, the index fluctuated between a low of 6,397.24 and a high of 6,903.61 before closing on 31 March at 6,713.63, representing an increase of 2.16% across the quarter.

Despite markets remaining lethargic in their return to pre-pandemic levels, Q1 2021 facilitated the most retail structured product maturities in a three-month period since the corresponding period in 2020.

Just 94 plans matured during Q1, which is four more than in Q3 and Q4 2020 combined. 76 plans successfully matured with a gain, 15 returned capital only, and three plans matured realising a capital loss.

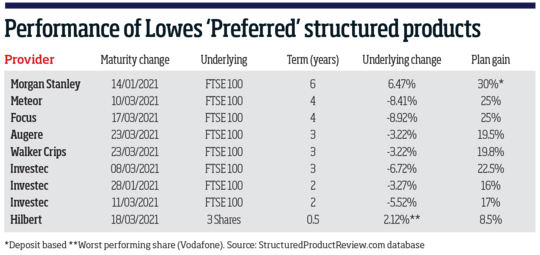

Sixteen Lowes ‘Preferred’ plans matured with all but two returning a gain.

Q1’s maturities produced an average annualised return of 5.06% across an average term of 4.08 years; Lowes ‘Preferred’ plans outperformed the sector’s average annualised returns by 1.38%, albeit over a slightly longer average term of 4.35 years.

The quarter witnessed the maturity of three Investec/Lowes 8:8 Plans (issues 1,7 & 8) and these, together with many others have significantly out-performed the underlying – most commonly the FTSE 100.

The table below shows the performance of the Lowes ‘Preferred’ structured products most commonly held by our clients, which matured in the first quarter of 2021.

Beyond the Morgan Stanley deposit (which achieved its maximum potential of 30% interest because the FTSE 100 was moderately higher over the six years) and the Hilbert high-risk, share-linked plan which ran for only six months, the others achieved annualised returns of between 5.7% and 8.1% over terms of two, three and four years, despite the pandemic-induced market fall.

The three loss-making plans in the quarter were term contacts paying a regular income, with capital returns derived from the performance of a basket of shares on a ‘worst of’ basis.

Such plans are inherently riskier than contacts linked to single indices such as the FTSE 100 or EURO STOXX 50. No Lowes ‘Preferred’ plans realised a loss for investors.

The top quartile of Q1 maturities returned an average annualised return of 8.83%, across an average term of four years. The best performing of these are summarised as below:

• Hilbert Investment Solutions Kick out Series 3 Stock Defensive Autocall Issue 5. This ‘Preferred’ plan, linked to the performance of a basket of shares, matured early after six months triggering the return of investors’ original capital in full, in addition to a gain of 8.5% – an annualised gain of 17.88%.

• Investec Defensive Enhanced Returns Plan 4 – EURO STOXX 50 Option. This ‘Preferred’ plan matured after six years, returning original capital in full in addition to a gain of 82%, despite the Euro Stoxx 50 being up by just 10%. This plan realised an annualised return of 10.49%.

• Meteor FTSE Kick Out Plan March 2020 (Citi). This plan matured early on its first anniversary, returning original capital in full in addition to a gain of 10.25%. This plan struck immediately after the market crash in March 2020 and as such benefited from a 22.25% rise in the FTSE 100 Index.

In support of our findings disclosed in Lowes’ Retail Structured Product Sector Review of the Decade 2010-2019, the most common underlying was the FTSE 100 Index, accounting for 59.57% of maturities in Q1.

No FTSE 10-linked contracts realised a capital loss, though seven did fail to mature with a gain as a function of the lethargic hangover from the March 2020 market crash.

In our Q3 2020 review, we referred to the introduction of a new index designed specifically for structured products: the FTSE Custom 100 Synthetic 3.5% Fixed Dividend Index (FTSE CSDI).

Prior to March 2021, the only counterparty offering products on the FTSE CSDI was Morgan Stanley. However, we are pleased to see Citigroup Global Markets Ltd and Goldman Sachs now offering the index as an underlying for retail structured products.

Last year, we stated our expectation for the index becoming a staple within the sector over the coming years and we expect that, once fully up to speed with the index, most advisers will concur.

The latest FTSE CSDI linked product is the Mariana 10:10 Plan May 2021, backed by Citigroup. Typically, the plan offers three capital-at-risk investment options with a maximum investment term of ten years, though the ability to mature early if the relevant criteria are satisfied on any anniversary from year two onwards.

Josh Mayne is structured products technician at Lowes Financial Management